Are European Markets on the Rise? Implications for Investors

Chapter 2 of Diversification in Turbulent Times

The US stock market has been having a stellar run – so much so that many investors fear it is overpriced. A moment ago, Nvidia became the first company ever to reach $5 trillion market cap. Since early 2023, the benchmark S&P 500 has risen more than 60 percent, hitting all-time highs despite headwinds ranging from tariff wars to concerns that artificial intelligence may be overhyped.

The United States is home to some of the world’s most formidable companies, many of which may be considered exceptional over the long term. However, the critical issue lies in their valuation. While the US market may not yet constitute the greatest speculative bubble in history, it ranks as a significant contender, surpassed only by the Japanese equities and real estate collapses of 1989, according investment strategists such as Jeremy Grantham and Felix Zulauf.

Zulauf describes the current US stock market as one of the most overvalued in history. Historically, bubbles driven by significant technological advancements attract excessive capital, leading to oversupply—a phenomenon exemplified by the construction of six railway lines between Leeds and Manchester in the United Kingdom during a past speculative frenzy. Grantham posits that the inevitable outcome is a profound market correction, or an “almighty crash,” a pattern that recurs with striking consistency.

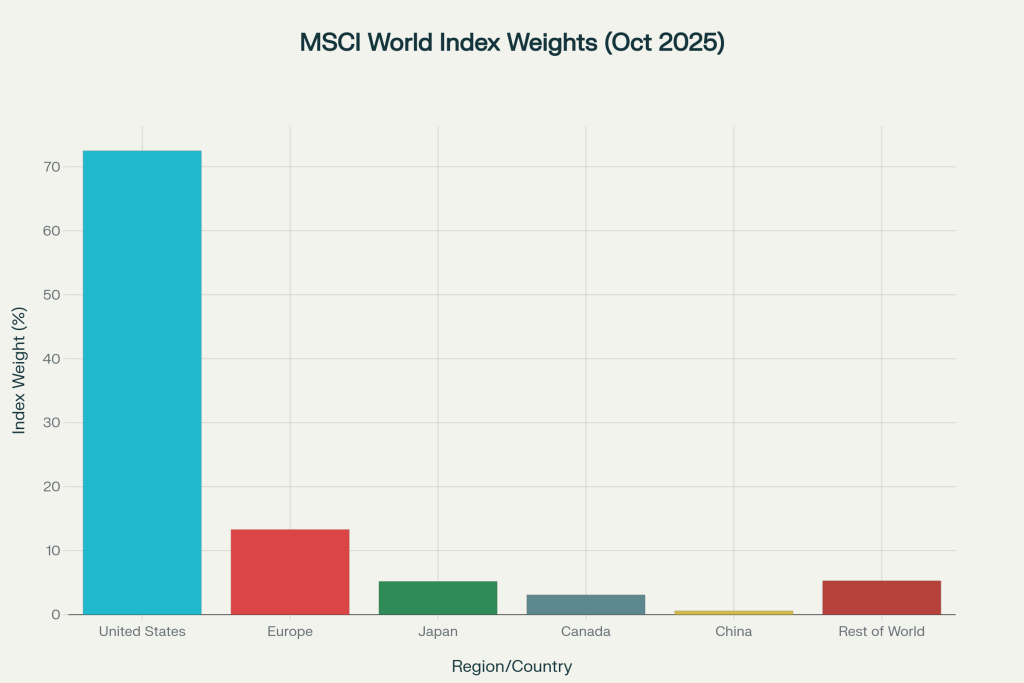

The US public stock market has experienced a remarkable decade of growth, with US stocks accounting for 70% of the MSCI world index today, yet historical precedent suggests that the next decade of asset appreciation may favour other regions or private markets. While it remains uncertain which market or region or sector will emerge as the leader, Grantham emphasizes a fundamental principle: valuations are of paramount importance. To return to a normalized valuation level—such as a Shiller PE ratio of 18 times, compared to the current 40 times in the US—the market could potentially decline by over 50%, he warns.

Opportunities in European Markets

Where, then, might investors seek refuge? The prudent choice lies in high-quality, low-debt equities with reasonable valuations. More pertinently, investors may consider diversifying capital to non-US markets. Grantham predicts that over the next decade, non-US stocks are highly likely to significantly outperform their American counterparts. Thus, it may be advisable to diversify one’s portfolio beyond an exclusive focus on US equities while the opportunity remains.

Some investors have already taken such steps. Year to date, European equities have been drawing renewed interest thanks to more favorable valuations, encouraging fiscal policies, and sector-specific opportunities. Concurrently, the euro has appreciated against the dollar by nearly 12% year-to-date, which suggest a notable shift in market momentum. The STOXX 600 index in Europe still trades at about 15.6 times forward earnings, versus the S&P 500’s 25, reflecting a persistent valuation discount that offers room for long-term growth. European stocks also offer higher dividend yields and attract investors seeking income.

Recent policy measures in Europe, such as Germany’s infrastructure program and potential for fiscal expansion, have further improved the region’s outlook. Notably, European indices have outperformed expectations, particular in sectors like aerospace and defence and energy infrastructure.

Beyond valuation, European equities present diversification benefits for portfolios heavily concentrated in US stocks. Over 25 years, US markets have experience stronger economic expansion, but structural shifts in Europe—including greater independence amid geopolitical uncertainties—are now catalyzing investment flows and making European markets attractive for risk-aware, globally diversified investors.

In conclusion, the shifting dynamics of global markets underscore the importance of adaptability and foresight in investment strategies. Investors who are overweight on US stocks may find greater stability and growth by allocating some capital to non-US equities, particularly in regions like Europe where momentum is building. Now, more than ever, a balanced and globally diversified portfolio could be the key to navigating the turbulent times ahead and securing long-term financial resilience.