AI: Disruption at Scale

Chapter 1 of How AI Is Changing Existing Industries

When history writes the current era of artificial intelligence, it may start not with algorithms but with an accounting ledger. In the scramble to build and operate immense AI platforms, the old rules of Silicon Valley – lean startups, asset-lite scaling, clear exits – are being torn asunder by a new logic: the business of AI requires colossal capital, tangled partnerships, aggressive kingmaking, and a degree of market entanglement that recalls the corporate dynasties and supply networks of Japan and Korea that have existed for a long time more than the classical modern-day American model.

Kingmakers and Platform Lock-In

Unlike the software booms of yesteryear, the winners in the AI race are those that have succeeded at more than technical innovation. Control over the means of compute – GPUs and custom silicon – has become both the prize and the platform.

“The demand for compute is insatiable,” remarks Jonathan Ross, Groq’s founder, distilling the industry’s logic: each leap in model capacity or inference performance unleashes new waves of demand, fuelling a feedback loop of supply, scale, and dependency.

Nvidia epitomizes the new business model: its lock on high-performance chips makes it not just a supplier but a “monopoly with buyer power,” as industry insiders put it. Firms from OpenAI to Google rush to secure allocations, structure side deals, and edge out rivals. The result is a market defined not by product features so much as by control over distribution and access.

Building a platform monopoly, however, is more than technical supremacy – it is a mastery of market structure. Nvidia’s stranglehold on supply allows it to extract lavish margins from buyers who, paradoxically, are racing just as hard to break the monopoly by building their own chips or negotiating elaborate supply deals.

OpenAI’s own partnership with AMD illustrates the shifting balance: OpenAI cut a deal for up to 10% of AMD, incentivizing a “second source” even as it remains tethered to Nvidia’s superior products. The kingmaker effect is increasingly about who can bestow platform value: more users, more demand, more clout.

Circular Financing and Bubble Risks

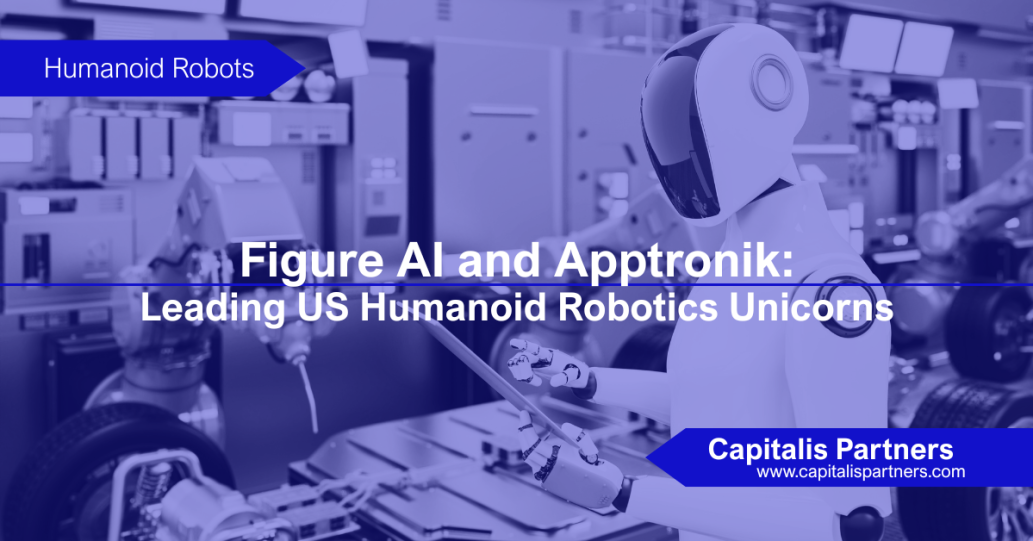

But the way money flows through AI is changing just as radically. Nvidia, Microsoft, Oracle, AMD, CoreWeave and OpenAI are entangled in a seemingly circular financial loop, and these are mostly publicly traded US tech companies.

Nvidia invests in CoreWeave, which in turn buys Nvidia cards and rents them out to Google, Microsoft and Meta. Oracle not only anchors cloud deals; it becomes a venture investor on behalf of OpenAI. OpenAI has a $300 billion deal with Oracle for cloud infrastructure, and Oracle, in turn, buys billions of dollars’ worth of chips from Nvidia to build those data centers.

Morgan Stanley analysts tracked the billions going round and round the AI data center rollout.

“The ‘AI circularity’ phenomenon is a fascinating example of how today’s tech giants are both competitors and collaborators. While this interdependence fuels rapid growth and innovation, it also challenges traditional notions of market competition. The current structure has created an interdependent system and such interdependence fuels rapid growth and innovation at the expense of traditional notions of market competition seen in the US capital market. This reminds us more of the corporate dynasties and supply networks of Japan and Korea (keiretsu and chaebol).

On the other hand, such structure can also mask fragility. “It looks solid – until demand dries up or new capital contracts,” said an industry veteran describing the flow. The multi-billion deals in AI are options on future demand more than present deliveries; true revenues trail projections, and few can guarantee end-user conversion beyond initial pilots. The amounts at stake are staggering: JPMorgan and McKinsey project $5 to $7 trillion in global AI infrastructure build-out by 2030, with capex far outpacing actual cash generation.

Venture Capital and “Kingmaking” at Speed

AI venture has also taken on a new form. Veteran VCs now chase velocity: “Success in private investing is rarely achieved at the first opportunity,” mused Thomas Laffont, CEO of $70b global technology investment powerhouse Coatue Management, reflecting on the tribal, zero-sum ethos of early-stage deals. Late-stage rounds have become grand exercises in “optionality,” with entry prices high and dilution low – founders hop from company to company, bringing technical lineage and network effects that draw instant rounds at breathless valuations.

These rounds are not just about funding development; they serve as signals and history-making. “Management teams are being incentivized with equity for growth grants to maintain energy through longer journeys,” reads another analysis. Boards are designed for scalability and momentum – the old model of exit via IPO or acquisition is now just one node in the journey. Empires are built by riding the waves, not by rushing to shore.

Shifting Power: Disruption Among Giants

Monopoly is not everlasting. The industry’s real risk lies in its own rapid expansion. As chip allocations falter and energy costs soar, the platform giants are furiously hedging bets.

Microsoft, Google, and Amazon each hedge vertically – building their own chips, partnering with sovereign energy vendors, and investing in AI unicorns with top talent and cutting edge innovations. Microsoft has invested $13.8B in OpenAI which is now worth more than 10 times. Google and Amazon have invested more than $12B in Anthropic, another leading US AI company that has dominated the enterprise market.

Conclusions: Disrupting at Scale

The business of AI is unlike any tech sector before it: capital-heavy, rapidly shifting, and beset by complexity from hardware to user acquisition. Every winning platform is both supplier and buyer; every round is both signal and insurance against being caught out.

The essence of disruption at scale is adaptability – organizing for learning, for supply resilience, for product evolution and for regulatory uncertainty. Only those who master the new logic – where “ecosystem breadth” and “enterprise orchestration” matter as much as technical performance – will secure the durable advantages on which new empires are built.

If the future of AI will be written in ledgers as much as algorithms, the lesson for business leaders and investors is clear: disruption is not just coming – here, it is already business as usual.

Unicorn Funds Interest Indication Form

We’re offering exclusive investment opportunities in top global unicorns. Share the companies you’re tracking or wish to gain exposure to by completing this form. We’d love your input.