It’s the liquidity, stupid!

Earlier this month, Donald Trump won the 2024 US presidential election with a historic comeback. “It’s the economy, stupid.”

In the PE/VC world, it’s the liquidity, stupid.

Today, let’s explore two themes in our investing world:

Theme 1: Funds and private company founders/employees all searching for liquidity

For LPs, you cannot eat MOIC (money on invested capital). You can only eat DPI (distributions to paid-In capital). Average age of a company is now 14 years, before going public. The liquidity mismatch between GPs and LPs has never been more pronounced, especially in the higher for longer interest rate environment.

For company founders and employees, they may also favour interim liquidity events in such a way that they can continue to drive growth and generate profits while waiting for better IPO timing. Traditional VC funding may not be able to support it.

Theme 2: Growth venture & PE started to merge

The lines between private equity and venture capital are blurring. VCs are going more mature and late stage and PEs are moving earlier, partly because tech companies have stayed private much longer and partly because there’s a lot of dry powder in the PE land (estimated to be $1.5 trillion at the end of 2023). That is raising the bar for everyone and requires managers to have not only deep experience in supporting ambitious founders and innovative companies in global expansion but also the dexterity and know-how to deal with structuring complexity and shifting capital markets.

What does that mean for our investors?

The current market presents opportunities for investors to enter promising ventures at reduced prices, especially as many companies are staying private longer and seeking alternative liquidity solution. By focusing on later-stage companies with proven revenue streams or a clear path to profitability, investors can mitigate the traditional risks associated with early-stage venture investing.

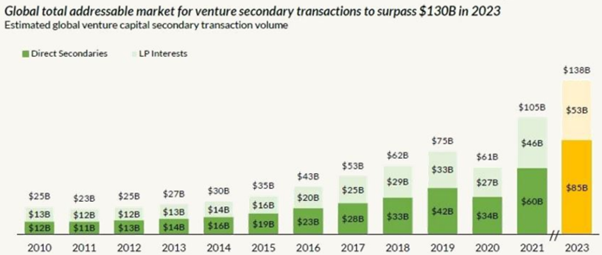

We believe the secondary market allows investors to gain exposure to high-potential companies that have already passed the initial volatile startup phase. As a hybrid capital solution provider and capital allocator, we will continue to find market inefficiency and serve as a liquidity provider whilst allowing our investors to gain exposure to private companies with tremendous potential at attractive valuation. The global addressable market for venture secondary transactions surpassed $130B in 2023. We believe there is ample opportunity to deploy capital in the years to come.

Best,

Capitalis Partners

Best,

Capitalis Partners

Best,

Capitalis Partners

Best,

Capitalis Partners

Related posts

April 27, 2023