European Private Equity 2022 Summary

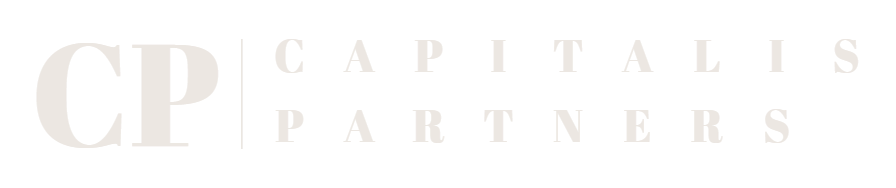

Private equity (PE) dealmaking remained healthy in Europe in 2022, with both deal value and deal count increasing year-over-year, a sign that private equity remains somewhat insulated from public market volatility. The asset class as a whole continues to grow in Europe as witnessed by record assets under management (AUM) within the industry in 2022. Dealmaking was characterised by smaller but more numerous deals, with mega-deals of over €1 billion hitting a nine-year low as PE cheques got smaller across the industry and borrowing costs increased. During 2022, we saw underlying themes growing, such as take privates, which allowed sponsors to take advantage of lower valuations; and bolt-ons, as companies seek to continue growing through mergers and acquisitions (M&A). In fact, we expect growth capital and take-privates to continue growing into 2023.

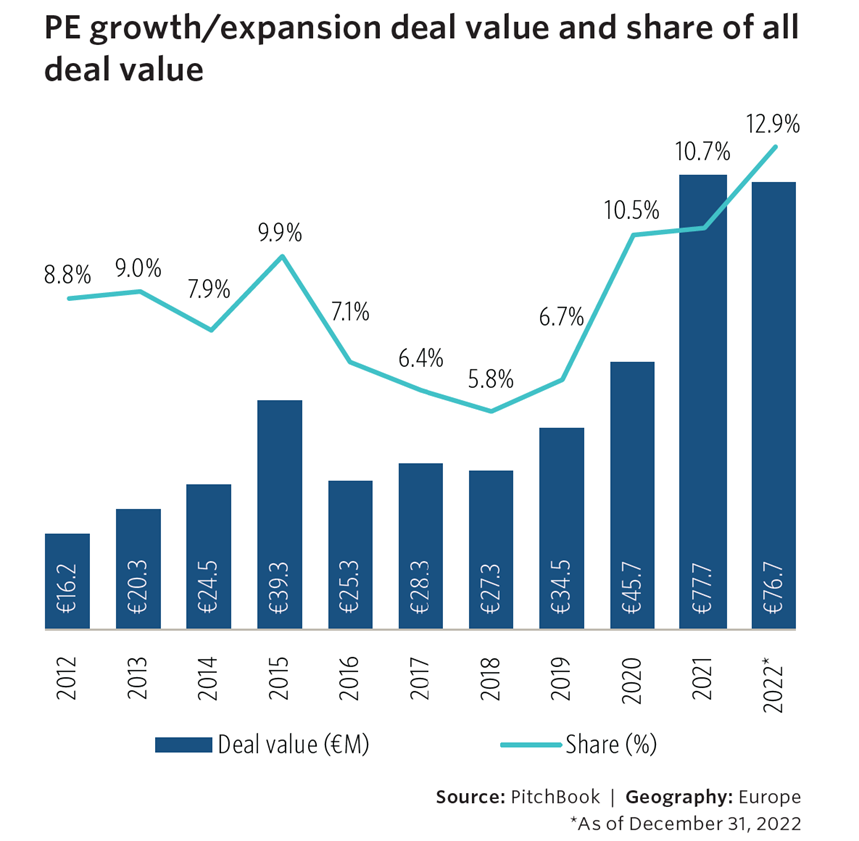

PE growth/expansion

Growth/expansion has become increasingly more popular as a type of strategy within the PE sector, hitting €76.7 billion in deal value in 2022. It has also grown in importance compared to other types of buyouts as it represented a record 12.9% of deal value in 2022. Growth/expansion is a newer strategy which targets growth companies rather than the usual mature leveraged buyouts (LBOs), which have historically characterised the industry. Sponsors are always seeking new ways to achieve higher returns, and in an environment with sluggish or no growth, this strategy offers more attractive risk-return profiles. 2022’s largest deal saw Blackstone recapitalise Mileway, the largest operator of urban warehouses in Europe, in a Q1 deal worth €21 billion that cements Blackstone’s investment thesis of rapid goods delivery. Blackstone launched Mileway in 2019 to operate the logistics assets it owns. Mileway has over 1,700 assets across 10 major European countries with a team of over 350 employees across 26 offices. Another example has been Octopus Energy, the UK utilities provider, receiving €536.8 million, the third-such deal for Octopus in as many years. Founded in 2015, Octopus Energy has grown very rapidly, now worth almost €5 billion, as it tries to disrupt existing legacy energy providers by offering greener and more affordable energy. Such a business profile attracts PE growth/expansion sponsors as it represents high growth in an attractive and historically high-barrier industry which is transitioning as a result of climate change.

Take-privates

Another popular theme of 2022 has been take-privates, which recorded their second-highest year at €37.3 billion in deal value across 31 deals. Taking a company from public to private has been a trend this year due to the falling public markets. This has offered private equity companies the chance to acquire public companies at a lowered valuation thanks to the aforementioned collapse in public markets, as well as the increase in interest rates, which lowers discount rates. The largest take-private this year saw Atlantia acquired by the Benetton family and Blackstone in a €19 billion deal. Atlantia’s stock has been falling since 2018, in part due to the tragic collapse of the Genoa bridge owned by Atlantia’s subsidiary Autostrade, which Atlantia was subsequentially forced to sell following the incident. The share price has fallen some 42% since the collapse, leading to the takeover proposal early in 2022. Similarly, Stagecoach, the UK bus operator, was acquired by DWS’s infrastructure fund in March of 2022 after they outbid rival bus operator National Express in a €707.7 million take-private deal following a 78.9% collapse in share price from December 2019 to Q4 2021 when takeover talks began. We believe take-privates will continue to be a theme into 2023 as public markets remain under pressure and we see attractive opportunities there.

Source: Pitchbook