Investing during stagflation

By Lyn Alden

Inflation, and specifically stagflation, makes investing more challenging.

Stagflation is when inflation is high, but growth is low or negative.

Cash and bonds are obviously a rough place to be, because their yields are often below the level of inflation in an inflationary environment. A bond is a promise to pay a certain amount of currency in the future, and the purchasing power of that currency is being diluted.

Stocks often don’t fare much better. If the purchasing power of currency is relatively stable, then it’s easy for companies to plan for the future, make long-term contracts, and so forth. If the currency is unstable, it makes planning much harder. A company’s revenue is rising as they raise prices, but their expenses are rising too, and it’s hard to predict whether revenue or costs will rise faster. In addition, as bond yields rise, it puts valuation pressure on highly-valued equities.

Real estate tends to do better than stocks and bonds, especially if you have a fixed-rate mortgage attached to it. The house price (asset) typically adjusts upward with inflation over time, while the the fixed mortgage (liability) gets inflated away. This depends on valuation though; in inflation-adjusted terms, a given house price might stagnate sideways for quite a while.

Industrial commodities (e.g. oil and copper) tend to be the big winners in inflationary environments. Almost by definition, if inflation is high, it means commodity prices are rising. Usually during inflationary environments, commodities are under-supplied, and it often takes years to bring on enough new supply, which weighs on real economic growth and contributes to a stagflationary situation. However, commodities can be very volatile, with sharp pullbacks even in environments that are beneficial for them.

Monetary commodities (e.g. gold and bitcoin) have an eventual correlation with inflation but not necessarily at the exact moment of high inflation like industrial commodities do. Gold in particular tends to do well during stagflationary environments, where economic growth is decelerating but inflation is still pretty high. It also tends to hold up well in outright recessionary/disinflationary environments, at least compared to equites.

This article explores some of the nuances on how assets perform in inflationary environments.

Monetary Inflation and Resource Constraints

Inflation is something that doesn’t have a precise definition. It depends on what school of economic thought you look at.

Monetary inflation refers to the growth of the money supply itself. If the number of monetary units is expanding more rapidly than various real-world resources (commodities, supply chain capacity, available labor, and so forth), then prices for various things will generally rise. This is because demand outpaces supply of real goods and services.

On the other side, we can look at commodity capex cycles to see when commodities are structurally oversupplied or undersupplied. We can also do this for global or regional supply chain capacity. So for an extreme example to illustrate the point, if the number of monetary units stays flat, while we bomb half the world’s shipping ports and half the world’s oil production facilities to pieces, then the price for the remaining shipping capacity and oil production will become a lot higher.

This is made more complex by the way economists measure price inflation. They put a bunch of goods and services together in a weighted basket, and estimate how that basket changes in price. Over time, they change the weighting of the basket, and change the calculations with hedonic adjustments and so forth, which usually reduces the official estimated level of price inflation.

Over time, technology is deflationary for most things, as it makes things more efficient. Software and electronics, for example, keep getting cheaper and better. And with automation and globalization, engineers have made it cheaper to manufacture basic things like clothes and shoes. However, technology is not equally applicable all things, and sometimes due to war or malinvestment, or just commodity capex cycles, we take a step back and become less efficient for a period of time, and thus more inflationary.

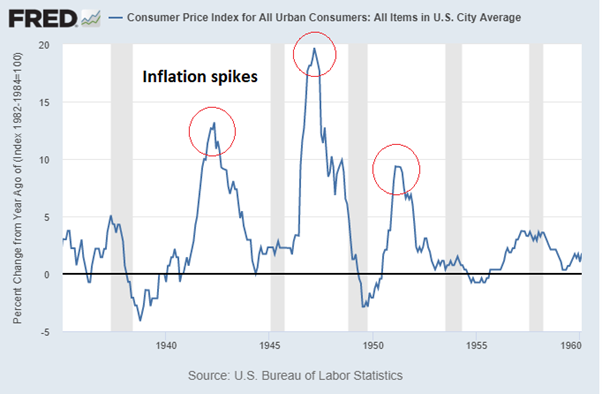

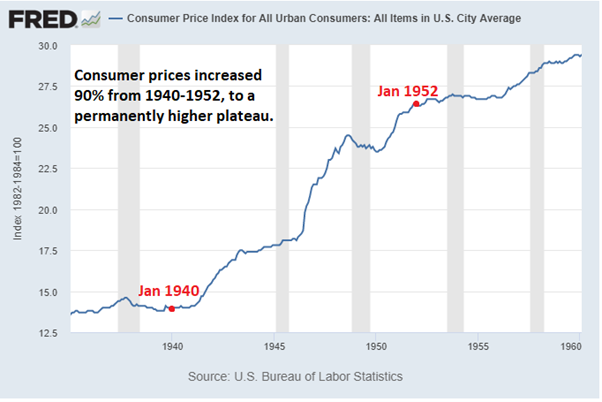

The big inflationary periods of history usually have a mix of both monetary inflation and supply-side bottlenecks. That’s why even when the supply-side bottlenecks are eventually resolved and the rate of change of inflation settles down, prices for most things are permanently higher; the amount of money in the system has become permanently higher.

For example, during World War II, inflation spiked in the United States. Eventually the rate of change settled down, but the level of prices for broad goods and services reached permanently higher levels.

Chart Source: St. Louis Fed

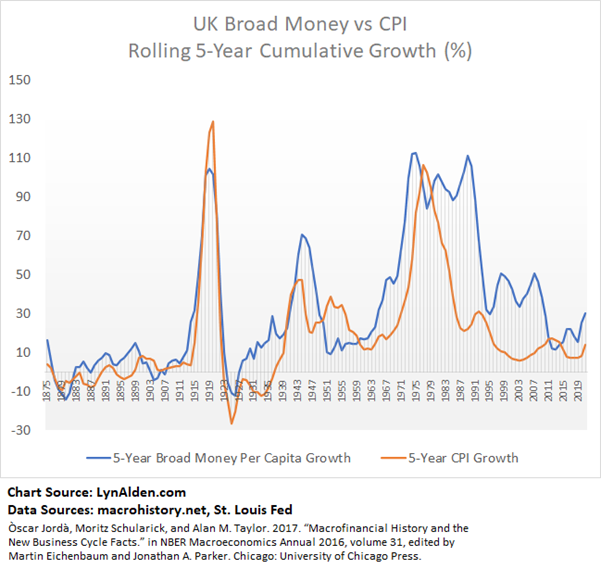

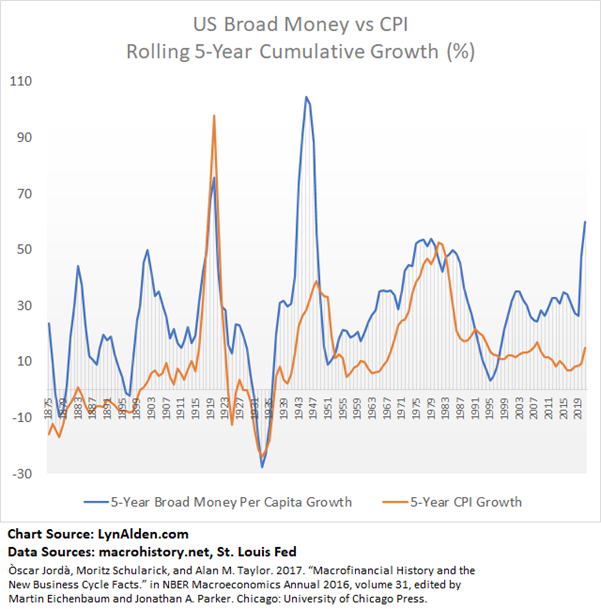

Monetary inflation and price inflation are rather correlated, when looked at over a long-term period. During periods where they are not correlated, it is typically because there is some massive abundance in commodity or labor resources, such as expanding across a new continent or tapping into some new labor pool.

Here’s the UK, which was already developed throughout this timeline and thus had very tight correlation between the money supply and broad price level over rolling 5-year periods:

Here’s the US, which experienced an untapped continent of resource abundance in the late 1800s (the first decoupling between money supply and price level) and exported a lot of its manufacturing base to China and other emerging markets during the 1990s through the 2010s to make use of cheap labor (the second decoupling):

Turkey: An Extreme Example

In the 1970s United States, both stocks and bonds performed poorly. Commodities and real estate did very well.

A lot of articles about inflation use the financial data from the US in the 1970s, but for this article, let’s use a modern example with an emerging market: Turkey.

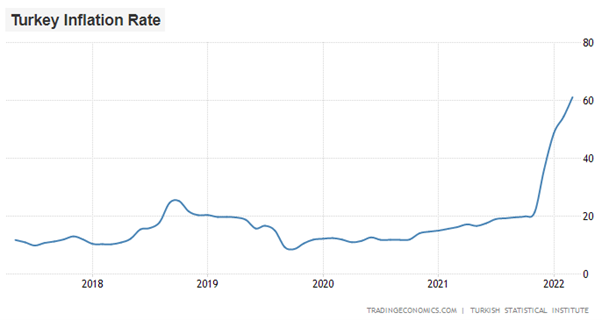

Turkey is experiencing very high inflation. However, unlike Venezuela, it’s not a broken economy with outright hyperinflation, at least not at this time. And Turkey is a G20 economy.

Chart Source: Trading Economics

Anyone who went into this period holding Turkish cash or bonds got eviscerated in terms of purchasing power.

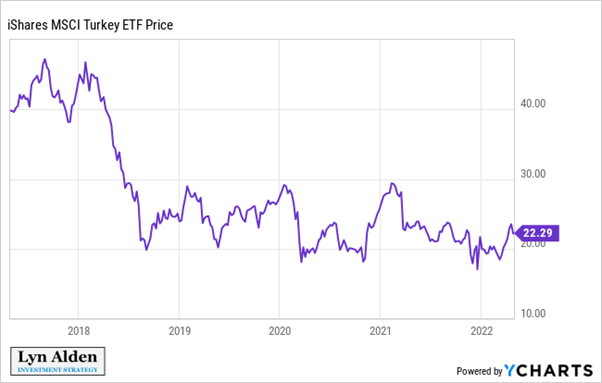

Meanwhile, Turkey’s stock market is up about 2.5x in local currency (lira) terms over the past five years:

However, in dollar terms Turkey’s stock market was cut in half and then trended sideways:

This is because valuations for Turkish equities have gone down, and it’s very challenging for companies to operate when the unit of account is degrading at such a rapid pace. Turkey’s GDP in dollar terms has been in a downtrend since 2013. That’s negative growth.

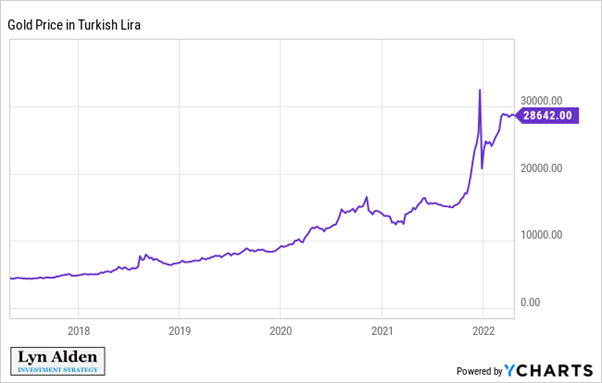

Gold in lira terms has done far better over the past five years, being up around 6x:

The same would be true for most commodities, with many of them having performed even better than gold.

Real estate is illiquid, often private, and thus harder to measure in real time. Here’s some data for Turkish house prices through 2021. They’ve approximately doubled over the past five years in nominal lira terms, while being flat in inflation-adjusted terms.

Chart Source: Global Property Guide

Now imagine you had this type of house price action in a market with long-term mortgages attached, and the mortgage is at a low interest rate because it was put in place before serious inflation occurs. For simple number purposes, suppose you buy a $100k house with a $20k down payment and a $80k fixed-rate mortgage. In five years, the house price doubles to $200k due to extreme inflation, and you still have approximately the same size $80k mortgage. Your home equity therefore jumped from $20k to $120k, minus maintenance, taxes, and fees. That’s pretty good; basically what you did was short the currency.

Real estate in highly-inflationary environments, depending on the jurisdiction, often gets rent-controlled. This limits its performance as an investable asset when it happens.

Overall, especially for a primary dwelling with fixed-rate debt attached, real estate is a reasonable defense against inflation. But of course, it’s not very portable or liquid.

Summary Findings

This example focused on Turkey over the past five years, but you’ll see similar trends if you look at highly inflation periods in developed markets and other emerging markets.

Generally speaking during unusually high inflation (which typically includes a significantly stagflationary element to it), bonds have a very bad time, stocks have a moderately bad time, levered real estate does great, and commodities or hard monies do great.

A Closer Look at Equities

“Equities” is a very big asset class. Some equities are unprofitable high-valuation growth stocks. Others are profitable low-valuation dividend stocks. Many are somewhere in between. Equities vary across industries and business models dramatically.

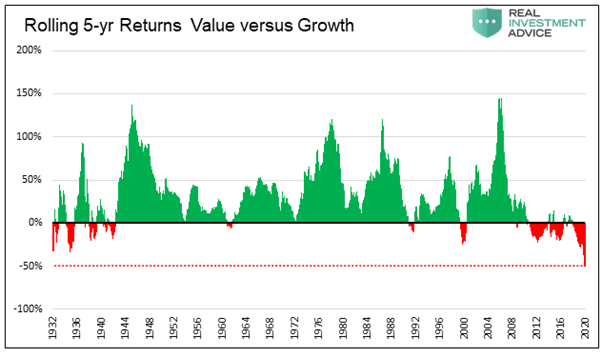

In inflationary environments, stocks that are classified as “value” typically hold up better than “growth” stocks. Here’s an example for US history through autumn 2020 (from which point there has been a period of value outperformance):

Chart Source: Michael Lebowitz, Real Investment Advice

The times of the biggest value outperformance were the 1940s, the 1970s, and the 2000s, which were also the three main inflationary decades during this period. The two decades where growth significantly outperformed were the 1930s and 2010s, which were the most disinflationary decades.

This is for a few reasons.

Reason 1) Valuation Pressure

Equities are valued compared to bonds in many cases. If nominally risk-free Treasuries yield 8%, then of course you would demand high returns (and thus low growth-adjusted valuations) for equities. On the other hand if nominally risk-free Treasuries only yield 1%, then you’re more willing to pay a higher price for decent equities. Even if you only expect 3-5% returns from them, it’s still better than Treasuries.

When inflation and bond yields move higher, it puts pressure on highly-valued growth stocks in particular. I went into detail on this in my January 2021 article called Interest Rate Effects on Equities. Here’s the main excerpt:

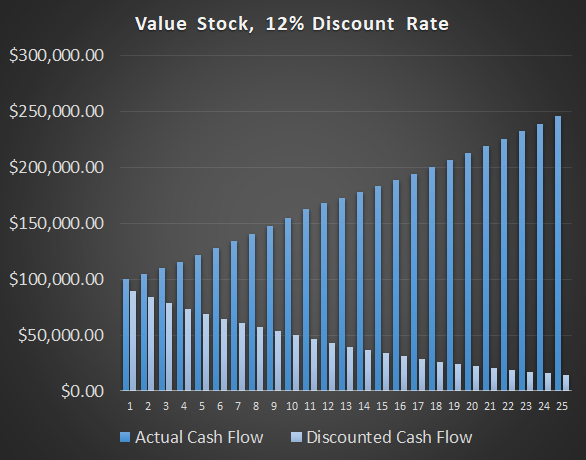

Value Stock DCF Example

Let’s say a company earns $100,000 in free cash flow per year. It’s a steady-state business, so we expect it to grow its cash flow by 5% per year for the next ten years, and then level out at 3% annual perpetually after that. That growth is just keeping up with population and currency inflation; its market share and volume per capita are rather static.

If we discount those future expected cash flows by a 12% rate, then the value of the next 25 years of cash flows would be $1.096 million:

In other words, we would be willing to pay a price/FCF ratio of roughly 11x, if we want 12% annualized returns on these cash flows.

If we were willing to look out further, and discount a couple more decades of the company running in perpetuity, we’d get to a little bit over $1.2 million for the valuation, or a bit over a 12x price/earnings. However, for this article I’ll stick with the 25 year forecast.

Now, suppose we’re analyzing the same exact company, but interest rates are 4% lower. So, due to lack of viable alternatives, we’re also willing to drop our discount rate by 4%, and so we use an 8% discount rate. Here’s the updated chart:

The 25 years worth of discounted cash flows for this updated model would be $1.586 million. In other words, we’d pay a price/FCF ratio of nearly 16x.

That valuation is 44.7% higher than our previous $1.096 million valuation assessment where we were using 12% as our discount rate for the same company.

It’s the same company, but with a lower discount rate and thus a higher fair valuation. Keep that 44.7% number in mind.

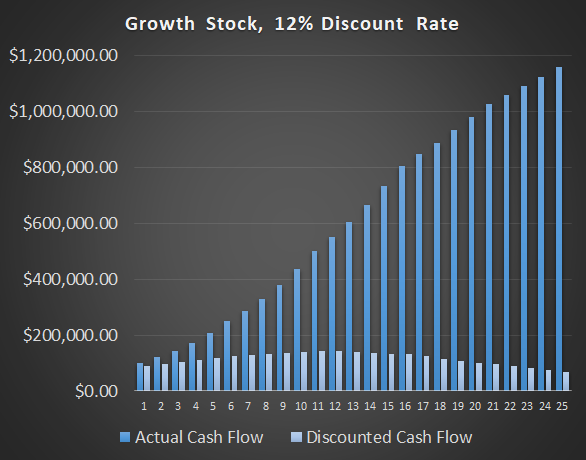

Growth Stock DCF Example

Now, let’s look at a second company, with a higher growth rate.

It starts with $100,000 in free cash flow per year, but it’ll grow that by 20% per year for the first 5 years, then 15% for the next 5 years, then 10% for the next 5 years, then 5% for the next 5 years, and then 3% thereafter once it’s fully matured.

If we discount those future expected cash flows by a 12% rate, then the value of the next 25 years of cash flows would be $2.860 million:

In other words, we would be willing to pay a price/FCF ratio of nearly 29x, if we want 12% annualized returns on these cash flows.

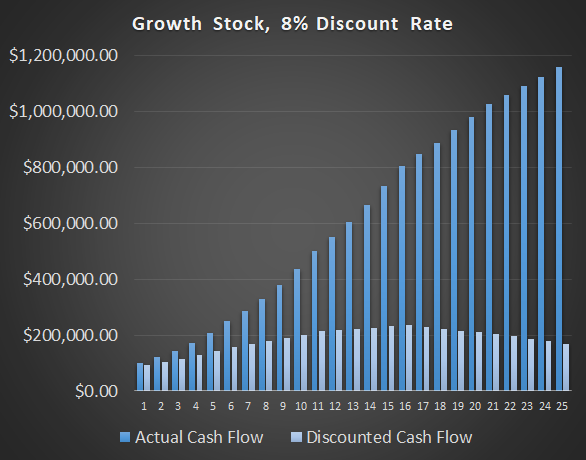

Now, if we analyze the same company using a lower 8% discount rate, here’s what we get:

The 25 years worth of discounted cash flows for this updated model would be $4.628 million. In other words, we’d pay a price/FCF ratio of over 46x.

That valuation is 61.8% higher than our previous $2.860 million valuation assessment where we were using 12% as our discount rate for the same company.

Notice that, during the same reduction in the discount rate from 12% to 8%, the growth stock had a notably larger percent increase in its fair value than the value stock (61.8% vs 44.7%). This is because the growth stock has a larger percentage of its expected cumulative cash flows occur far into the future compared to the value stock that is more front-loaded, so a larger portion of the growth stock’s expected cumulative cash flows are subject to the multi-year compounding effect of the discount rate.

The growth stock is more rate sensitive, in other words. Whenever we have a big shift to lower interest rates, and the market expects those low rates to persist for a while, then it’s not surprising to see a surge in valuations of growth stocks during that transition from higher to lower rates.

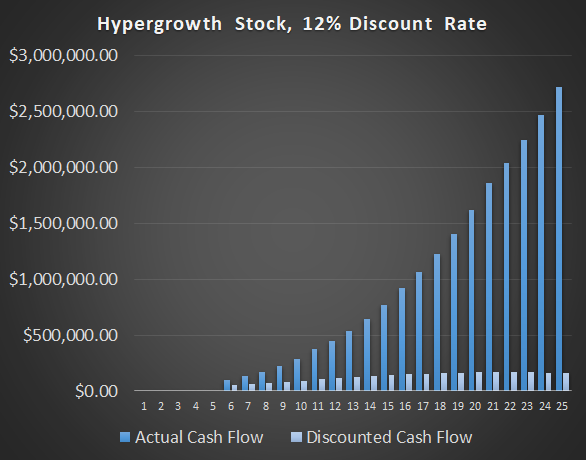

Hypergrowth Stock DCF Example

Lastly, let’s look at a third company, with an even higher growth rate.

For the next five years, it won’t be profitable at all. Once it establishes positive free cash flow on the sixth year, it grows that by 30% for the next 5 years, then 20% for the next 5 years, then 15% for 5 years, then 10% for 5 years, and then 10% for the next 5 years, and so on.

If we discount those future expected cash flows by a 12% rate, then the value of the next 25 years of cash flows would be $2.589 million:

Now, if we analyze the same company using an 8% discount rate, here’s what we get:

The 25 years worth of discounted cash flows for this updated model would be $4.917 million.

That valuation is 89.9% higher than our previous $2.589 million valuation assessment where we were using 12% as our discount rate for the same company.

So, the hypergrowth stock is even more rate sensitive than the growth stock (61.8%), let alone the value stock (44.7%).

-Lyn Alden, January 2021

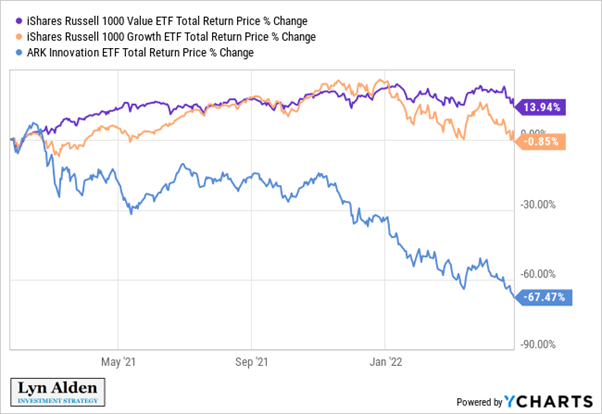

Since then, we’ve seen a massive divergence in performance between value equities, growth equities, and hyper-growth equities as inflation and bond yields ramped higher:

Reason 2) Inflating Inventory Value and Replacement Cost

During disinflationary environments, inventory is often considered a liability in practice. Companies do their best to focus on just-in-time delivery, inventory reduction, and so forth. This optimizes their capital efficiency. Inventory that is held too long, or in too large amounts, represents capital that could have been spent more productively elsewhere. This is also true for asset-heavy business modules, such as pipeline companies and manufacturing facilities and so forth.

This rapidly changes during environments where the cost of goods is rising and there are multiple delays and shortages in acquiring various goods. Suddenly, having a big inventory is a good thing; the value of that inventory tends to increase while it is held, and it buffers the company from shortages and disruptions. Assets that are hard to build tend to go up a lot in value, since their replacement cost is so much higher now.

Imagine, for example, how much more expensive it is to build a new manufacturing facility or pipeline in 2022 compared to just three years ago in 2019. There is 40% more money in circulation in the US. Labor costs are higher. It’s more difficult to get construction supplies. Regulatory complexity has increased. Everything about building this infrastructure is more expensive than before.

Companies that have been sitting on valuable and hard-to-replace infrastructure, suddenly look a lot better in an inflationary environment. In a world of supply-chain scarcity and energy scarcity, most of the existing energy production assets, energy transportation assets, manufacturing capacity assets, and shipping/transportation capacity assets, become a lot more valuable.

And many value stocks have a decent amount of debt alongside those fixed assets, which results in a sharp jump in effective book value (regardless of whether it’s recognized right away) as those assets are revalued.

Final Thoughts

The world has been in a disinflationary trend for about four decades. Commodities have been abundant, and new pools of labor from China and former Soviet territory connected with the global market.

The brief inflationary exception during this four-decade period was the middle of the 2000s decade, where commodities became scarce and expensive. However, this wasn’t strongly felt in developed countries other than for a brief period of time; most of these inflationary pressures were exported to emerging markets. The cost of labor continued to be suppressed despite this inflation, because there was an abundance of cheap foreign labor.

In the 2020s decade, this is all different. Commodities are once again scarce. But unlike the 2010s, labor is also scarce. China is no longer ramping up manufacturing capacity like they were in the 2000s, and their working-age population is actually decreasing now. Global shipping capacity is constrained. Wars are occurring, which reduces globalization and forces duplication of resources in various ways.

A key thing to keep in mind is that inflationary environments are rarely linear. In other words, there are often brief disinflationary periods even during inflationary decades, and I think the 2020s will be similar. The macro environment continues to look inflationary, but not necessarily in a straight line.